Table of Content

Being a Chase checking account holder can qualify borrowers for a 0.25% rate discount. They'll also take a close look at the information within your credit reports—not just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on.

So if you have a card with a $1,000 credit limit, to optimize your credit score youll want no more than $100 outstanding on the statement date for the card. Industry-specific scores are fine-tuned based on the specific risks of each industry. Other factors, such as the loan amount, the home’s location, your down payment and loan type can all play into whether you’ll be approved and your mortgage’s terms. And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant's FICO 2, 4 and 5 scores are pulled.

Most Important: Payment History

For instance, some people may want to close their credit cards if they have trouble avoiding overspending or the card has an annual fee that doesn't seem worth paying. Equifax credit scores are not used by funders and creditors to assess consumer creditworthiness. The FICO score is a general purpose credit score developed by Fair Isaac Corporation, which is used by funders and creditors to assist the credit value of consumers.

Monitoring your credit can alert you of suspicious activity and show you how your use of credit affects your score. Experian Creditworks is free and gives you monthly access to your Experian credit report and FICO Score. Theres also a paid version that includes access to FICO Scores and credit reports from all three credit bureaus monthly, and to Experian credit reports and FICO Scores daily. Because there are three major consumer credit bureaus , each with its own version of your credit report, you can also have different credit scores.

How Does Your Credit History Affect Getting A Mortgage

Well, one option would be to get your official FICO score from myFICO--where you can actually get credit scores from all three major bureaus. As you can see, your credit score will have a material effect on the interest rate and monthly payments on your new mortgage, or if you’ll even be approved for the loan at all. You owe it to yourself to do whatever is necessary to make sure your credit is in shape to get a loan approved but also provide you with the best interest rate you deserve. But what may be even more relevant when it comes to credit scores and conventional mortgages is the impact your credit score will have on the interest rate you’ll pay on your loan.

Banks use a slightly different credit score model when evaluating mortgage applicants. Below, we go over what you need to know about credit scores you're looking to buy a home. If you want to see your FICO® scores, however, you can easily buy them online from the MyFICO website, and possibly find them for free from your bank or credit card issuer.

FICO® SCORE — THE SCORE THAT LENDERS USE®

This can typically be done online for free, and it will give you averified answer about your home buying prospects. Since mortgage companies loan money on the scale of $100,000 to $1 million, theyre naturally a little stricter when it comes to credit requirements. As the name suggests, the middle score is the one in the middle of your three scores. For instance, if your credit report shows 690, 700, and 710, then 700 is your middle score.

It is recommended that you upgrade to the most recent browser version. View your car’s estimated value, history, recalls and more—all free. FHA.com is a privately-owned website that is not affiliated with the U.S. government.

Increase Your Available Credit

And since you may be wondering, if a mortgage applicant has no usable FICO scores, generally they won't qualify for a mortgage. If you fall into this category, contact a mortgage broker to see what options you have. Lenders have identified a strong correlation between Mortgage performance and FICO Bureau scores .

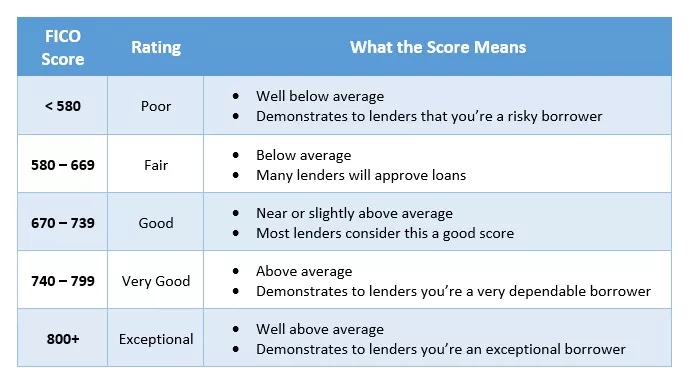

With FICO, everyone is assigned a score ranging from 300 to 850. The worst a lender can do is say no, leaving you exactly where you started. In the best-case scenario, youll get a big credit limit increase, dropping your credit utilization ratio and giving your credit score an immediate boost. That means that one of the easiest ways to boost your credit score is to decrease your credit utilization ratio. You can do this by paying down debt or increasing your credit limits.

This is the closest thing there is to a mortgage for bad credit. On a 30-year mortgage, that comes to an incredible $95,760 over the life of the loan. This article/post contains references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Experian websites have been designed to support modern, up-to-date internet browsers. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

While you can likely qualify for a home loan with a rate lower than the median, a higher credit score typically means better interest rates and loan options. In general, if you have higher scores, youre more likely to qualify for most credit cards. But if your credit is fair or poor, your options will be more limited and you may receive a lower credit limit and higher interest rate. Different lenders have different requirements for their loans.

No comments:

Post a Comment